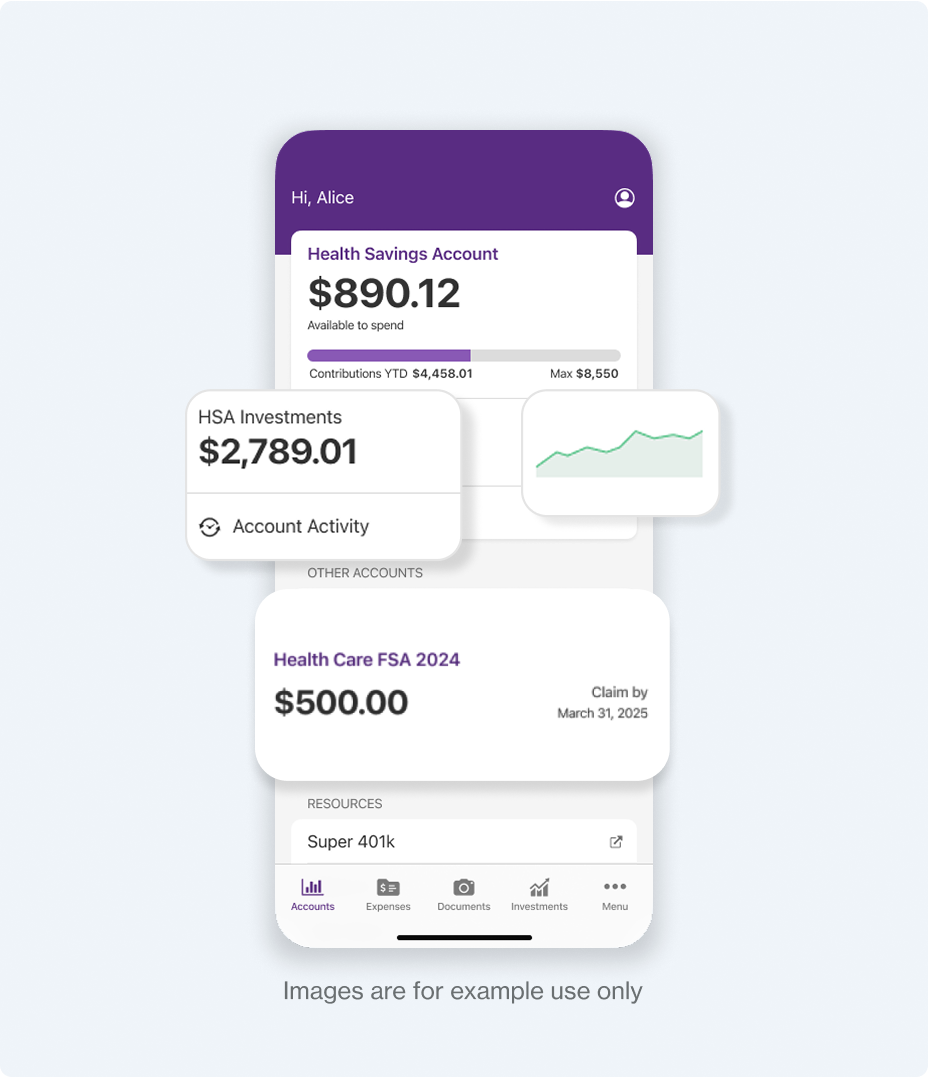

Open a Health Savings Account

Unlock More Affordable Health Savings with HealthEquity

A Health Savings Account (HSA) is a tax-advantaged way to save, spend, and invest in healthcare expenses. Open and HSA and make a contribution, and we'll match the first $251.

Already have an account? Access it here

Why a HealthEquity HSA?

Pay for healthcare

HSAs cover thousands of qualified medical expenses, including doctor visits and over the counter medications.

Get $25 on us

Open and contribute to your account and we'll match the first $25.

Use pre-tax dollars

Helps make health expenses easier to manage, so you can save for other things that matter.

Save for the future

An HSA offers ways to watch your money grow, to build a nest egg or use toward tomorrow's health needs.

What is an HSA?

An HSA is a tax-advantaged savings account that you can use to cover qualified medical expenses now or in the future. Now, ACA Bronze plan members are eligible for this benefit to help make healthcare more affordable.

Now including ACA Bronze Plan Members

Can I open an HSA?

You can open an HSA with HealthEquity and start saving on out-of-pocket healthcare costs if:

- You have a high-deductible health plan (HDHP) or an eligible ACA Bronze Plan.

- You're not enrolled in another non-qualified health plan.

- You're not enrolled in Medicare

- You're at least 18 years old and not claimed as a dependent

Health Savings Account FAQs

-

Who is eligible to open an HSA?

You’re eligible to open an HSA if you’re enrolled in a qualifying high-deductible health plan (HDHP), are not enrolled in Medicare, and are not claimed as a dependent on someone else’s tax return.

Save, grow, and invest with an HSA.

Keep more of your money today, roll over unused funds for the future, and set aside a tax-free nest egg for retirement.

Save on your healthcare

Use tax-free money to pay for doctor visits, prescriptions, and dental care.

Grow your future savings

Your HSA funds never expire — they carry over every year with no use-it-or-lose-it.

Invest in your retirement

An HSA works like a second 401(k) — grow a tax-free nest egg for retirement.

HSA Resources

Article

Am I eligible for a Health Savings Account?

Online Guide

Explore our HSA Guide

Page

Qualified Medical Expenses

1The $25 match is a limited-time offer, subject to change or termination at any time. To receive the match, your HSA must remain open and in good standing for at least 90 days.Return to content

HealthEquity does not provide legal, tax or financial advice. Always consult a professional when

Copyright ©2025 HealthEquity, Inc. All rights reserved

Let's HSA!

First, tell us who you are:

COBRA/Direct Bill Employer login

Please refer to your Client Welcome email for the URL of your specific COBRA/Direct Bill Employer login page.

Follow us